As football fans get ready for the big game – one of the biggest beer holidays of the year, accounting for more than $1 billion worth of beer sales, according to Nielsen IQ – a growing number of them will be making their purchases online.

Some 10% of shoppers say they’ll be making their beer purchases through e-commerce channels, according to data compiled for Molson Coors Beverage Company. That piece of the pie is worth at least $120 million.

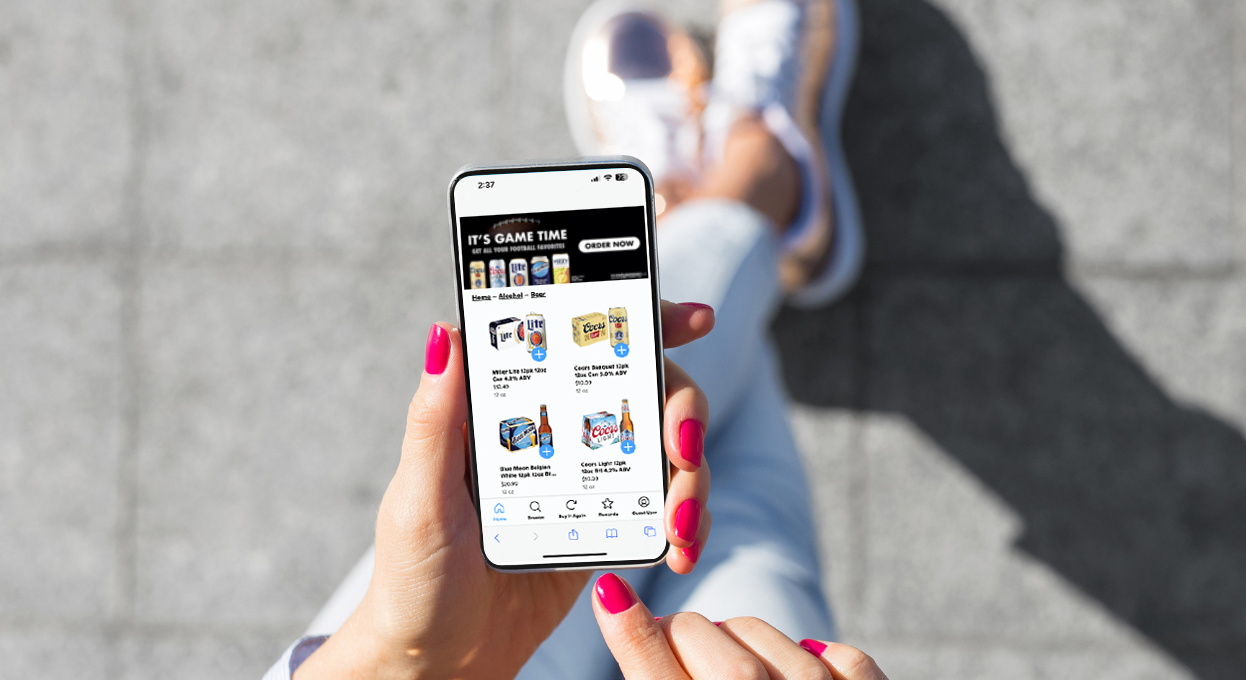

“Fans don’t want to miss kickoff, and if they haven’t bought beer for their gathering yet, it’s very convenient to place an order on an app on your phone and have it delivered to your door,” says Stephanie Spesia, senior marketing manager for e-commerce at Molson Coors. “Shopping online offers conveniences you can’t get from other traditional formats.”

And consumers – more than 80% of them – tend to do most of their online shopping for the Super Bowl within a week of the game, according to a recent Shopper Pulse survey conducted on behalf of Molson Coors.

With the game fast approaching, Molson Coors is working with retailers to ensure consumers easily can find Molson Coors’ brands in their online journey.

The company is investing behind sponsored searches and banner ads on grocery, liquor store and e-commerce platforms like Drizly and Instacart. It’s planning paid social media and digital ads promoting online buying and partnering with distributors to meet the increased demand around the game.

“We believe there’s a huge opportunity here, not just with online as a sales channel, but as a marketing tool that allows us to reach consumers in new ways,” Spesia says. “E-com helps us grow our brands, build loyalty and give consumers something they’re asking for: the ability to shop when and how they want.”

Online opportunities

E-commerce has become an increasingly powerful channel for retailers: The web is the main source for consumers to research and discover products, and Forrester estimates 70% of purchases will be digitally influenced by 2027. What’s more, retailers that engage consumers online are more apt to sell more goods when those shoppers make a purchase, either online or in store, marketing research firm Acosta found.

And as more people migrate more of their purchases online, opportunities abound.

The online channel has experienced massive growth since 2019, kickstarted by the pandemic. Today, it accounts for about 4% of beverage alcohol sales, according to beverage industry analysis firm IWSR, which projects the channel to grow to 6% by 2026.

Between 2019 and 2021, grocery stores’ online alcohol sales grew from $441 million to $1.6 billion, according to Rabobank. The firm predicted that number to reach $1.87 billion in 2022.

“There are some people predicting that ecommerce will be about 10% of the business in the next five to eight years, and that’s equal to the size of the on-premise. That’s a big wake-up call,” says Ethan Stienstra, founder of the E-Premise Group, a consultancy that helps manufacturers and retailers optimize their digital alcohol sales platforms.

Molson Coors is answering – investing online in a big way, increasing online sales to distributors, offering direct-to-consumer sales in Canada and the U.K., and jumpstarting its marketing efforts on leading e-commerce platforms.

With e-com becoming an essential part of the sales mix, here are four takeaways as football fans prepare to stock up for the big game.

Awareness is key

Chances are you and most people you know have made an online purchase in the last year, maybe even the last week. But when it comes to buying beer online, 35% of consumers aren’t aware it’s even an option, Spesia says. But when they do, nearly 70% of shoppers say they are very or extremely likely to buy beer online again, according to data collected for Molson Coors.

“You can’t overestimate the importance of letting people know of the online option,” Spesia says. “If retailers don’t showcase the category on their homepage or in emails, they risk losing sales.”

Highlight winning brands

Stienstra agrees that building awareness is critical. Making it easy for consumers to find the products they’re looking for is an important way to help make the sale, he says, whether through search-engine advertising or on a homepage.

“Pick those winning brands,” he says. “Make sure you’re featuring the most popular brands, like Coors Light and Miller Lite. You want to make sure you have plenty of stock and (feature them) when people are looking to buy through the e-commerce channel, for delivery, curbside or inviting them to come into their store to purchase it.”

Furthermore, data compiled for Molson Coors show, more than 30% of shoppers will go to another source if they can’t find the product they’re looking for. Retailers should make sure their websites reflect their inventory, too, Spesia says.

“You want to match intent for what the consumer is shopping for. If someone is searching for a Blue Moon 12-pack, and it’s out of stock, recommend a Blue Moon six-pack instead of another brand or segment,” she says. “There’s always an opportunity to make sure your systems match that intent.”

Younger legal-age drinkers are already ordering online

It’s no secret that younger consumers – digital natives raised on mobile screens – are an influential and essential cohort. Legal-age Gen-Z and millennials make up more than half of online alcohol shoppers, according to IWSR. In fact, according to IWSR, the majority of digital consumers buying online since 2020 are under age 40.

That online behavior is part of the younger consumer’s DNA, Stienstra says.

“It used to be you go to a website and do your research, but now people are going straight to Google, Drizly and Instacart,” he says. “We’re definitely seeing younger legal-age beer consumers researching brands and buying on their phone.”

An estimated 32.6 million drinkers make online alcohol purchases – including 31% of whom used the web for their latest purchase, according to IWSR. Those trends are poised to grow.

And for retailers who haven’t embraced the digital revolution, Spesia has one piece of advice: “Start today. This is something consumers are asking for,” she says. “When we make it easy for them, we all win.”